Upcoming Industry Changes - What You Need to Know

Upcoming Industry Changes - What You Need to Know

New Updates Will Have Significant Impact on Local Businesses

Business owners and financial professionals are facing two key accounting changes that can significantly impact both tax and accounting reporting. The Financial Accounting Standards Board (FASB) has released major updates that will go into effect in the next two years. These time-consuming changes are expected to dramatically increase the complexity of financial reporting.

Revenue Recognition (ASC 606)

Effective Dates: After December 15, 2018 for privately-held businesses

The FASB standard on Revenue Recognition could potentially alter the way many businesses recognize revenue and related contract expenses, which could then impact the business’s bottom line as well as the tax return. Publicly-traded companies have already implemented this standard which will become effective for all privately-held businesses for fiscal years beginning after December 15, 2018. This standard will eliminate the current rules-based revenue recognition model that currently contains very specific rules for different industries and move towards a principles-based model regardless of industry. The core principle of this new model makes the transfer of control of the goods or services provided to the customer the focal point of determining when and how a business can recognize revenue for those goods and services.

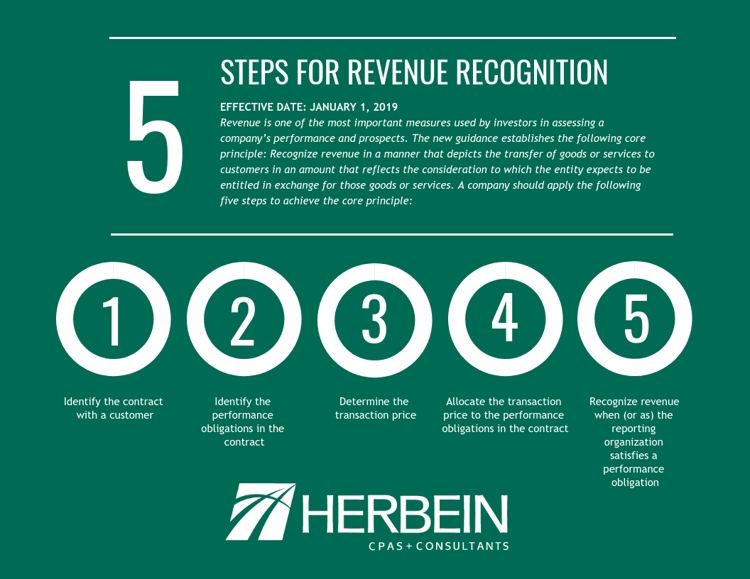

The framework includes a new five-step process that businesses are required to follow when determining proper revenue recognition. Each step of the process presents different challenges for businesses, and each step will also require management to make assumptions and estimates that could affect the timing and amount of revenue to be recognized. The new standard also includes expansive new disclosure requirements, both quantitative and qualitative, that will give any user of the financial statements a transparent look at the business’s revenue recognition policies, estimates and assumptions. Your business may need to gather extensive data not currently collected for these new disclosure requirements. To be successful in implementing this new standard, businesses need to perform a review of their contracts with customers as well as their current revenue recognition practices in order to determine how those contracts and practices line up within the new principles-based framework. This internal review could result in the need for your business to make changes to its accounting, contracting, sales and marketing processes, systems and policies.

----------------------------------------

Lease Standard (ASU 2016-02)

Effective Dates: January 1, 2020

Looking ahead, the FASB also issued the Accounting Standards Update (ASU) 2016-02, Leases, a new standard that will govern the accounting for leases for non-public companies beginning January 1, 2020. This ASU signifies the culmination of the FASB’s almost decade-long project to enhance the accounting for leases, particularly the overall transparency of lease obligations within a company’s financial statement.

The most significant change as a result of the update is the requirement that companies will now have to recognize all leases – both operating and capital (finance under the new ASU) – on their balance sheet.

Depending on the size and composition of a company’s existing lease portfolio, this could potentially add significant lease liabilities to their balance sheet. Consequently, this would result in unfavorable impacts on debt covenants and key performance metrics. For example, adoption of the ASU would result in an increase in a company’s leverage ratio and debt to EBITDA, while decreasing their current ratio.

Overall, the ASU has the potential to significantly impact a company’s financial position and reported results. Adopting this ASU will most likely require substantial time and effort on the company’s workforce. Accordingly, companies should start the process of understanding how the ASU differs from current guidance and assessing how changes will impact their overall business. Getting a jumpstart will allow more time for proper execution of the adoption phase, giving companies a better chance of an overall successful implementation.

Many companies have known about these new standards in advance, but as with much change, proper planning and implementation are they keys to successful compliance. The beneficiaries of these standards will be those analyzing financial statements and tax returns and require an established ‘apples-to-apples’ methodology. Implementation will not be pain-free, but in the long run, the benefits of accurate and comparable financial reporting will be strengthened.

Article prepared by Kyle D. Levengood, CPA, CFE and Christopher S. Kunkle, CPA, CFE, CITP.

As published in the Reading Eagle Business Weekly.