Beware! Tax scams continue to increase

A recent IRS Security Summit addressed identity theft and other threats

During its Security Summit on July 11, the IRS reminded taxpayers and tax professionals to be aware of threats of tax-related identity theft. Identity thieves continue to develop new scams to acquire personal information to facilitate filing fraudulent tax returns or selling information to others.

It is important to know what to look for to mitigate the risk of identity theft.

In addition to the identity theft warnings in the IRS Security Summit, we are aware of the following recent tax scams:

Employee Retention Credit Claims (ERC mills)

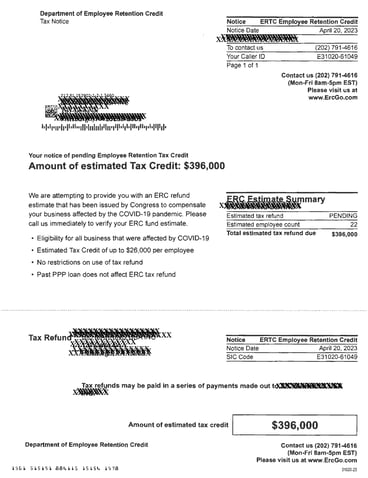

As indicated in our previous tax blog Employers beware: IRS to scrutinize aggressive Employee Retention Credit (ERC) claims, the IRS has been cracking down on bogus ERC claims. Notwithstanding the IRS enforcement efforts, scams related to false ERC claims continue to increase. One recent scheme involves this letter that appears to be an official IRS document indicating an estimate of a potential ERC credit. Indications that this is bogus include the sender identified as “Department of Employee Retention Credit,” which does not exist, a return phone number of (202) 791-4616 rather than a toll-free number, and finally this website reference www.ErcGo.com, which is not an official .gov website.

As indicated in our previous tax blog Employers beware: IRS to scrutinize aggressive Employee Retention Credit (ERC) claims, the IRS has been cracking down on bogus ERC claims. Notwithstanding the IRS enforcement efforts, scams related to false ERC claims continue to increase. One recent scheme involves this letter that appears to be an official IRS document indicating an estimate of a potential ERC credit. Indications that this is bogus include the sender identified as “Department of Employee Retention Credit,” which does not exist, a return phone number of (202) 791-4616 rather than a toll-free number, and finally this website reference www.ErcGo.com, which is not an official .gov website.

Please be aware of these unsolicited letters or notices regarding an ERC claim. Contact your Herbein tax consultant if you have questions regarding such a letter or notice, or the Economic Retention Credit in general. Also, if you suspect the sender of the false letter or notice is attempting to perform illegal tax-related activities, you may want to submit Form 14242, Report Suspected Abusive Tax Promotions, or Preparers to report the ERC promoter.

Phishing scams (including false notices regarding Economic Impact payments)

It is important to always remain on high alert for phishing scams – the attempts to trick you into providing personal and confidential information. The IRS Security Summit outlined that taxpayers and tax professionals should be aware of the different terms, and what these scams may look like. Malicious actors engaging in phishing scams will use mass emails, text messages, and calls to attempt to acquire sensitive information by posing as organizations such as the IRS. Some of these scams, referred to as spear phishing, are a more targeted approach that generates a more individualized message to create a sense of familiarity for the desired target.

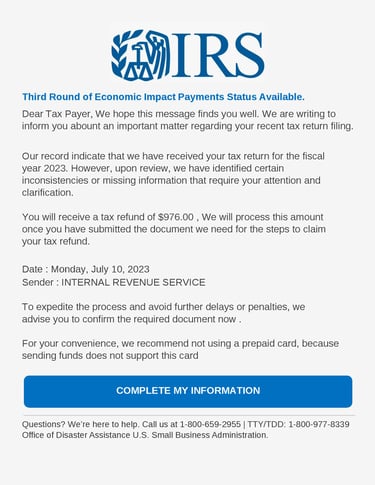

One recent phishing scam is this Economic Impact Payment notice. A review of this notice indicates a few flags that it is not legitimate, since it refers to receipt of fiscal 2023 tax return information, which has not been filed yet, and the identification of the sender as Office of Disaster Assistance, which is not a legitimate department within the Small Business Administration (the correct department is Office of Disaster Recovery and Resilience.) Please contact your Herbein tax consultant if you have questions regarding such an Economic Impact payment or another suspicious notice or letter. Also, scams can also be reported to the IRS by sending a copy of the message as an attachment to phishing@irs.gov.

One recent phishing scam is this Economic Impact Payment notice. A review of this notice indicates a few flags that it is not legitimate, since it refers to receipt of fiscal 2023 tax return information, which has not been filed yet, and the identification of the sender as Office of Disaster Assistance, which is not a legitimate department within the Small Business Administration (the correct department is Office of Disaster Recovery and Resilience.) Please contact your Herbein tax consultant if you have questions regarding such an Economic Impact payment or another suspicious notice or letter. Also, scams can also be reported to the IRS by sending a copy of the message as an attachment to phishing@irs.gov.

Final thoughts

As phishing and other scams to acquire personal information become more sophisticated, it is important to remain vigilant in recognizing potential risks. Again, please contact your Herbein tax consultant if you have questions regarding any tax notice or letter that you receive.

Article contributed by Olivia Schmid