Clarifying Contributions and Exchange Transactions

Clarifying Contributions and Exchange Transactions

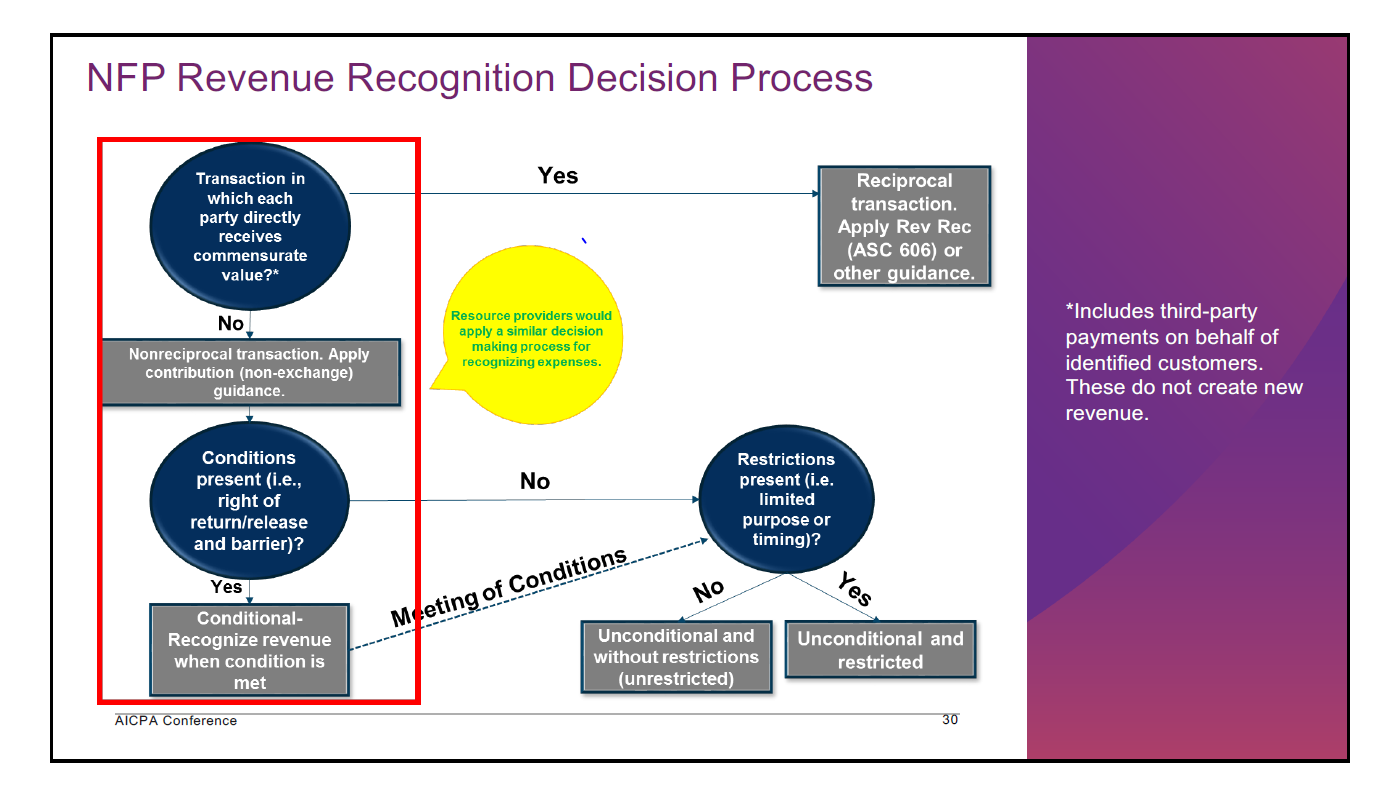

The Financial Accounting Standards Board (FASB) ASU 2018-08, Clarifying the Scope of the Accounting Guidance for Contributions Received and Contributions Made, is effective for fiscal years beginning after December 15, 2018. The update provides a framework for determining whether a transaction should fall under contribution guidance or revenue recognition guidance for accounting purposes. There has been a divergence in practice in this area and FASB clarified the guidance in preparation for the new revenue recognition standards.

The guidance clarifies that an exchange transaction differs from contributions because the resource provider/customer receives a benefit of equal value from the transaction. Benefits received by the general public do not constitute a benefit to the resource provider. If the resource provider does not directly receive a proportional benefit, the transaction falls under the contribution guidance. For example, if an organization receives a foundation grant for playground equipment, the community is receiving the benefit, not the foundation. Therefore, this transaction would fall under the contribution guidance.

Under contribution guidance, it is necessary to determine if the contribution is conditional or unconditional. Conditional transactions must have a barrier that must be overcome by the organization AND a right of return or release of the donor obligation. For example, if an organization receives funding that requires them to serve meals to 50 individuals (barrier) or the funds must be returned (right of return), the contribution would be conditional. A receivable would not be booked for a conditional contribution until the related barrier is overcome. If a conditional contribution is advanced to an organization, a liability is recorded until the barrier is overcome.

When recording revenue for your nonprofit organization. You should consider the items included above to determine the underlying transaction type. The following decision tree will assist you with working through that process.

Article prepared by Marybeth Olree. Contact us at info@herbein.com for additional information.